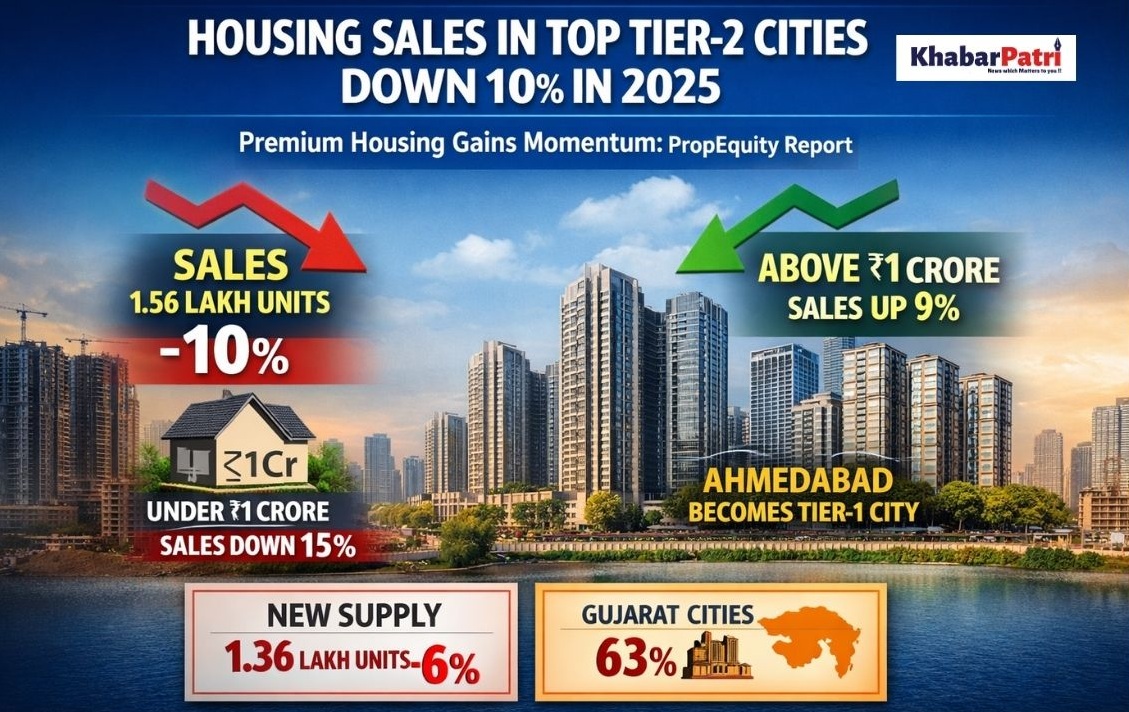

National : Housing sales across India’s top 15 tier-2 cities declined 10% year-on-year in 2025 to 1,56,181 units, even as the overall sales value remained stable at ₹1.48 lakh crore, according to a report by NSE-listed real estate data analytics firm PropEquity. The slowdown reflects rising housing prices, affordability pressures, and a visible shift towards premium housing.

While most cities witnessed a drop in sales volumes, Mohali and Lucknow bucked the trend, recording growth of 34% and 6% respectively. Visakhapatnam saw the steepest decline, with sales falling 38% year-on-year. The report highlighted a clear premiumisation trend in tier-2 markets. Sales of homes priced below ₹1 crore declined 15% in 2025, with their share falling to 72% from 77% in 2024. In contrast, homes priced above ₹1 crore recorded a 9% rise in sales, increasing their share to 28% from 23% a year earlier.

Significantly, Ahmedabad is now being regarded as a tier-1 housing market from 2026, having surpassed several established tier-1 cities in both housing launches and absorption. The four Gujarat cities — Ahmedabad, Gandhinagar, Vadodara and Surat — together accounted for 63% of total sales in the top 15 tier-2 cities, with Ahmedabad alone contributing 33% (51,148 units).

Samir Jasuja, Founder & CEO, PropEquity, said: “The slowdown in housing sales over the past two years is largely due to a shrinking supply of homes priced below ₹1 crore — a segment that traditionally drives demand in tier-2 cities. Rising land and construction costs, along with changing buyer aspirations, are pushing new launches into higher price brackets. As a result, tier-2 markets are increasingly mirroring tier-1 cities, where volumes are declining even as prices continue to rise.”

He added that government focus on tier-2 cities through infrastructure development, improved connectivity, and industrial corridors has driven sustained price appreciation, pushing even mid-segment homes beyond ₹1 crore in many markets and slowing overall absorption.

New Supply Declines

New housing supply across the top 15 tier-2 cities fell 6% year-on-year to 1,36,243 units in 2025 from 1,45,139 units in 2024. Supply contraction was seen across segments, with launches of homes priced below ₹1 crore declining 5% and those above ₹1 crore dropping 8%.

Mohali (108%), Bhopal (66%), Ahmedabad (3%) and Jaipur (2%) recorded growth in new launches, while Bhubaneswar saw the sharpest fall at 57%. The four Gujarat cities together accounted for 64% of total housing launches in 2025.

The report cautioned that rising affordability pressures could increasingly impact not only premium housing but also the affordable and mid-income segments in tier-2 markets going forward.