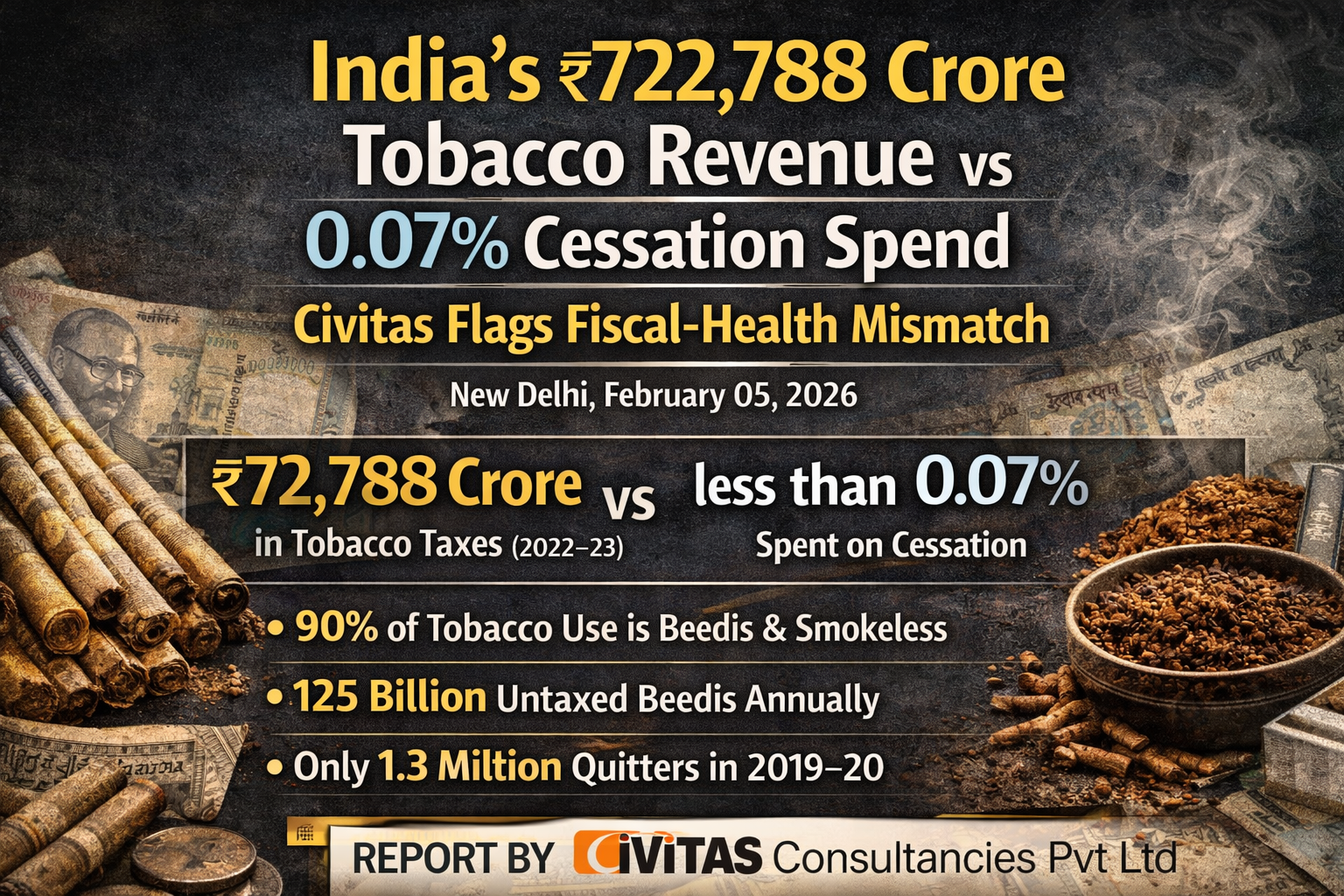

New Delhi : India’s tobacco control framework is facing a serious fiscal and policy imbalance, according to a new white paper released by Civitas Consultancies Pvt. Ltd. The report, “Assessing India’s Tobacco Control Framework,” reveals that while tobacco taxes generated ₹72,788 crore in FY 2022–23, less than 0.07% of this revenue was allocated to the National Tobacco Control Programme (NTCP), resulting in weak cessation coverage and uneven implementation.

The study highlights a structural gap in policy focus. While regulations remain largely cigarette-centric, cigarettes account for only 10% of India’s tobacco consumption, whereas beedis and smokeless tobacco dominate nearly 90% of the market, much of it operating in informal and low-tax segments.

Civitas estimates that 125 billion beedi sticks annually escape taxation due to exemptions for unbranded products, creating a large shadow economy, revenue leakage and sustained affordability of harmful products. The report also notes that between 2015–16 and 2022–23, only 38% of approved NTCP funds were utilised, indicating implementation inefficiencies and state-level disparities.

Despite India being the world’s second-largest tobacco consumer, cessation services remain limited and underused, with only 1.3 million users accessing support in 2019–20 — less than 0.5% of total users.

The report calls for a structural reset through tax harmonisation across all tobacco products, removal of beedi and smokeless tobacco exemptions, and creation of an Inter-Ministerial Tobacco Sector Transformation Council to align fiscal, labour, agriculture and health policies. It also recommends ring-fencing at least 10% of tobacco tax revenue for cessation and alternative livelihood programmes, alongside stronger enforcement and expanded track-and-trace systems.

Civitas concludes that without coordinated reform, India’s tobacco sector will continue to face high informality, tax leakage and weak public health outcomes.